En route to London from Geneva at the end of the GAIM Ops Conference last Friday, I remembered how four years ago when I used to fly regularly on business to Geneva I was always amused by the inconsistency of airport security.

At Geneva in common with other airports the queues for security are always a major bottleneck. Nothing metallic, nothing sharp. A body search if the detector signals the metal in your belt too much or the steel toe caps in your shoes unacceptable. Fair enough – we all need to feel safe. Mercifully they don’t bother with the pointless rigmarole of the liquids rule of British airports when you can buy plenty of inflammable liquids duty free air side. Once you have been through all of that, had the nail file on your nail clippers snapped off and consigned for recycling as scrap metal and assured the security guards that your blunted metal collar bones were not weapons, you emerge at the other end of security duly sanitised and safe. There in front of you would be the ubiquitous array of duty free shopping and what always caught my eye was the display of Swiss Army knives on sale. Yes – Swiss Army knives for sale, after the security checks, air side. Not behind a secure cabinet but piled high on display hooks available for handling and inspection by all and sundry………!

One evening after a particularly inconvenient security check process, I saw a British Airways captain browsing in the shop with the Swiss Army knives and when I pointed out the futility of the security checks when these were on sale, he simply laughed and said when one thought of all the damage one could do with items freely available on the aircraft alone – Swiss Army knives were the least of his worries.

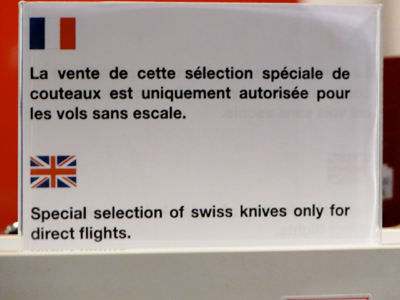

So four years on, having gone through the formalities of security checking, I thought I would see if the shop was still there and indeed it was, as were the knives – albeit with a much wider choice in styles and sizes. But they had introduced an important restriction – it was now available for sale only on direct flights and additionally when I questioned the shop assistant she assured me that the Swiss Army knife versions with serrated edges were the ones not available air side because they were the really dangerous knives! Lets hope that they don’t have too many incidents of shop lifting either.

With that reassurance and the announcement of a delayed flight and suppressing the urge to buy a knife and test whether hoards of security staff would descend upon me, I thought I would spend some time reading the technical call for advice on level 2 implementation of the AIFMD. I assure you it is good bed time reading.

I thought I would cover Part II on the Depositary but I think the draughtsman for Article 21 suffers from the same Swiss Army knife syndrome of the Geneva airport security system.

Functionally and hierarchically separating a depositary function from prime brokerage does not really solve any problems. In fact it misses the risk altogether in my view – and the fact that you can delegate the custody tasks anyway simply takes away with one hand and gives back with the other. Perhaps the European regulators are on their own mission to stimulate the economy through a requirement for professional advice! The risk that they should focus upon is the operation of collateral when there is leverage or other forms of borrowing. Most assets will not be held by a depositary – they will be held by prime brokers as collateral and will be available generally for re-hypothecation. What this means is that for every $100 lent the prime broker will hold around $140 of fund assets as collateral. It is how that is managed and realised and how the segregation obligation is implemented around the unencumbered assets that is far more important – even when you are looking at a Lehman style situation – than some of the things proposed by the regulators. Having a depositary does not make the assets safer – it is what can and cannot be done with the assets that determines their safety. Lenders will not lend unless they are protected against a borrowers default – and how a lender exercises those rights is far more important than having the assets sit with a third party when they can be collateralised.

Those involved in the industry really do need to engage with the regulators to help them understand the issues so that we get sensible, consistent and effective regulation to create a healthier industry – but with all this red tape you will probably need to buy that Swiss Army knife to cut a clear path through it all. It would at least be some consolation that the knife could be duty free.

©Jaitly LLP